For many international investors, the United States serves as a land of immense opportunity, a place to build a future, and a reliable haven for their families. Nevertheless, the path to permanent residency typically seems like navigating a complex and intricate maze. This is where the EB-5 Immigrant Investor Program enters the picture, serving as a reliable compass for those looking to make a substantial contribution in the U.S. economy in exchange for the coveted copyright. As an investor exploring your options for U.S. immigration, this detailed guide is created to resolve your queries and illuminate the journey ahead. We will examine the specifics of the program, from the starting investment to the final steps of securing permanent residency, using the framework provided by U.S. Citizenship and Immigration Services (USCIS) to provide you with the most precise and dependable information at your fingertips.

Main Insights

- The EB-5 visa program offers a proven route to obtaining a U.S. copyright through investment, calling for a capital commitment of $800,000 in a Targeted Employment Area (TEA) or $1,050,000 elsewhere.

- The process involves submitting Form I-526/I-526E, receiving a two-year Conditional copyright, and then filing Form I-829 to remove the conditional status.

- Investment seekers have the opportunity to select from a managed investment option through a Regional Center or a active personal investment method.

- Thorough documentation of the legal origin of money is a critical requirement that can significantly impact positive petition outcomes.

- Individuals applying from high-volume regions may face waiting periods and should track the Visa Bulletin for movement in priority dates.

- The initiative provides permanent residency for program participants and their immediate family, with a potential pathway to U.S. citizenship after a five-year period.

Your Guide to Understanding the EB-5 copyright by Investment

The EB-5 copyright by investment represents more than a simple visa; it is an entryway to a new life in the United States. Administered by USCIS, the program was designed to stimulate the U.S. economy through capital investment and job creation by foreign investors. As a reward for their contribution, investors, as well as their spouses and unmarried children under 21, can acquire a copyright, granting them the ability to live, work, and study anywhere in the country. This route is one of the most trustworthy routes to permanent residency, as it doesn't need sponsorship from an employer or relative, offering a degree of autonomy that is highly attractive to worldwide investors and business professionals.

The EB-5 visa program serves as a testament to America's commitment to economic growth through foreign investment. Different from other immigration routes that depend on family relationships or employer sponsorship, the EB-5 route allows investors to take control of their immigration destiny through purposeful capital investment. This independent approach attracts experienced business professionals and investors who prefer to rely on their own financial resources rather than outside sponsorship.

Understanding EB-5 Investment Requirements: A Clear Guide

At the core of the EB-5 program exists the investment component. The required capital contribution isn't necessarily a standardized amount; it depends on the specific area of the project you choose to invest in. Understanding these financial requirements serves as the fundamental and crucial stage in your EB-5 journey. USCIS has set two distinct investment amounts that demonstrate the economic development priorities of the United States administration.

Understanding the Dual Thresholds: $800,000 and $1,050,000

A potential investor has to contribute at least $800,000 when investing in developments established in a Targeted Employment Area (TEA). On the other hand, the minimum investment increases to $1,050,000 for projects located beyond these special regions. These figures are deliberately set; they are carefully calculated to channel funding into high-priority locations, and the variance is substantial enough to make the project location a crucial strategic element.

The investment requirements were set with careful consideration to guide foreign capital to economically disadvantaged regions. The $250,000 disparity between TEA and non-TEA investments acts as a considerable incentive that may affect investment choices and general investment approach. Investors should diligently consider not only the financial implications but also the long-term viability and employment generation prospects of projects in get more info diverse regional zones.

Understanding TEA Zones: The Geographic Advantage in Employment Areas

A key element of a Targeted Employment Area (TEA) is a cornerstone of the EB-5 program. TEAs are classified as either a rural area or a location experiencing high unemployment, specifically areas with unemployment rates of at least 150% of the national average. The decreased investment threshold of $800,000 for projects within TEAs is a powerful incentive aimed at guide foreign capital into communities that have the greatest need for economic development and job creation.

For investors considering a TEA-based project, there's more than just lowering the required capital investment; these ventures can additionally offer benefits including expedited processing and excellent opportunities for fulfilling the program's rigorous job-creation standards. Making the decision about a project within a TEA can thus become a crucial factor that influences the entire trajectory of your EB-5 visa copyright submission. Because TEA designations are regularly reviewed and updated periodically, it is essential for investors to validate current standing prior to committing to any project.

Launching Your American Dream: The I-526/I-526E Form Process

After identifying your investment project, the official pathway for your EB-5 copyright begins with submitting Form I-526, or Form I-526E for Regional Center investors. This submission to USCIS has to clearly establish that your investment fulfills all program requirements. This involves not only investing the mandatory investment funds but also submitting a thorough blueprint outlining how the investment will generate at least 10 full-time positions for U.S. workers.

The I-526/I-526E application serves as the basis of your entire EB-5 petition. Every subsequent step in the process is contingent on the completeness and accuracy of this initial filing. The filing must showcase a compelling business case that establishes not only conformity to program requirements but also the feasibility and longevity of the projected job creation. USCIS adjudicators examine these petitions with considerable attention to detail, making thorough preparation critically important.

Proving Your Legitimacy: The Source of Funds Requirement

An essential part of the I-526/I-526E petition is the verification of the legitimate source of your investment funds. USCIS places substantial importance on this portion of the application, and you will be required to provide a detailed and traceable documentation of the source of your capital. This involves presenting thorough financial documentation, including bank statements, tax returns, and verification of property sales or other transactions, to establish a complete and complete chain of records that your funds were gained through legitimate means.

The thoroughness of your source of funds documentation can significantly impact the outcome of your application. USCIS demands complete traceability of funds from the initial source through every transaction leading to the EB-5 investment. This documentation needs to cover foreign exchange transactions, intermediary movements, and any loans or gifts related to putting together the investment funds. This complex requirement usually demands partnering with skilled experts who comprehend the precise documentation requirements expected by USCIS.

The EB-5 Path: Deciding Between Investing in Regional Center or Direct Investment Approaches

The popular EB-5 immigrant investor program features two different routes for investors: making an investment via a USCIS-approved Regional Center or making a direct investment into a new commercial enterprise. Selecting between these options will depend on your individual objectives, how involved you want to be, and how much risk you're willing to accept. Each option comes with unique benefits and considerations that must be carefully evaluated based on your particular situation and objectives.

A Regional Center serves as an economic unit, public or private, that works toward promoting economic growth. Regional Centers are widely favored since they facilitate a more passive investment approach, combining resources from numerous investors and administering ventures for their benefit. They also feature more adaptable job creation calculations, permitting the consideration of secondary and induced job creation in addition to direct employment. This expanded job creation approach can make it easier to satisfy the program's employment requirements.

Direct investing, on the other hand, necessitates a greater level of involvement, where the investor directly participates in the management of the business. This method provides more oversight but also demands a higher level of management involvement. Direct investments need to show job creation through exclusively direct hiring, which can be more challenging but also more transparent and verifiable. The decision between these approaches should match your investment strategy, available time for involvement, and comfort level with different types of business risk.

The Two-Year Journey: Life with a Conditional copyright

After the approval of your Form I-526/I-526E petition and as soon as a visa becomes available according to the Visa Bulletin, you and your eligible family members will be granted a Conditional copyright, which is valid for two years. This is a significant milestone, permitting you to reside in the U.S. and commence your new life. Nevertheless, as the name indicates, this status is conditional and includes specific obligations that have to be completed to keep your legal status.

During this two-year period, your investment capital must continue to be fully invested and at risk in the project, and the project must keep working toward fulfilling the job creation criteria. This period functions as a testing period, during which you must show your ongoing commitment to the conditions of the EB-5 program. The conditional nature of this position means that not meeting program conditions can lead to the revocation of your copyright and probable removal from the United States.

Living as a conditional resident provides most of the benefits of permanent residency, such as the ability to work, travel, and access certain government services. Nevertheless, the conditional status imposes continuing regulatory requirements that demand diligent tracking and record-keeping. Investors are required to maintain detailed records of their investment's performance, job creation progress, and compliance with residency conditions throughout the conditional period.

Achieving copyright: Your Guide to Form I-829

To change from a conditional resident to a lawful copyright, you are required to file Form I-829, the Petition by Investor to Remove Conditions on copyright Status. This application has to be filed during the 90-day period before the two-year anniversary of your entry to the U.S. as a conditional resident. The I-829 petition is the final step in demonstrating that you have met all the conditions of the EB-5 program.

It is necessary to provide evidence that your investment remained active throughout the two-year provisional term and that the necessary 10 full-time jobs for U.S. workers were generated or sustained because of your investment. Upon approval of your I-829 petition, the conditional requirements on your copyright will be eliminated, and you will receive copyright status. This represents the completion of your EB-5 journey and the realization of your objective of obtaining permanent U.S. residency through investment.

The I-829 application requires thorough documentation demonstrating conformity to all program requirements throughout the conditional residency. This encompasses financial documentation verifying continued investment, employment records confirming job generation, and proof of the investor's sustained engagement in the enterprise. The quality and completeness of these documents directly influences the probability of petition success and the positive removal of conditional residency.

The Art of Patience: Navigating Backlogs, Priority Dates, and the Visa Bulletin

For those from countries heavily pursuing EB-5 visas, such as China, India, and Vietnam, the path to obtaining an investment copyright USA can involve a substantial waiting period. This is due to the annual per-country visa caps established by the U.S. Congress, which restrict the amount of visas that can be granted to nationals of any single country at 7% of the total annual allotment for each visa category.

When you file your I-526 petition, you are assigned a "Priority Date," which effectively determines your place in the processing order. The Visa Bulletin, published each month by the U.S. Department of State, provides updates on visa status and tracks the flow of priority dates for respective region. You have to watch the Visa Bulletin to keep up with the movement of priority dates and to understand when a visa is going to be available to you.

As the old saying goes, "patience is a virtue," and this is particularly relevant for EB-5 investors from oversubscribed countries. It is crucial to factor these potential waiting times into your long-term planning and to acknowledge that the immigration process could require several years from start to finish. An experienced EB-5 visa attorney can deliver crucial support in handling these intricacies and developing strategies to manage the waiting period efficiently.

Unlocking a World of Opportunity: Exploring the Benefits and Advantages of the EB-5 Program

Even with the demanding criteria and potential waiting periods, the EB-5 program presents multiple benefits that render it a popular immigration route. The most significant feature is the possibility for the investor, their spouse, and their unmarried children under 21 to acquire permanent residency in the United States. This creates numerous options, including the ability to reside, work, and pursue education across across the nation without needing a sponsor.

The EB-5 program offers unparalleled versatility versus other immigration pathways. Unlike employment-based visas that tie you to a specific employer or location, the EB-5 copyright enables total geographic and professional flexibility. You have the ability to start a business, switch professions, or pursue education without immigration constraints. This freedom is notably beneficial for entrepreneurs and business professionals who appreciate flexibility and autonomy in their career choices.

Moreover, after maintaining permanent residency for five years, EB-5 investors and their loved ones may qualify to pursue U.S. citizenship, concluding their path from investor to American citizen. The path to citizenship through EB-5 is simple, calling for only the preservation of copyright status and adherence to standard naturalization requirements. This marks the crowning accomplishment of the American dream for numerous international investors and their loved ones.

Questions and Answers

What is the EB-5 copyright process?

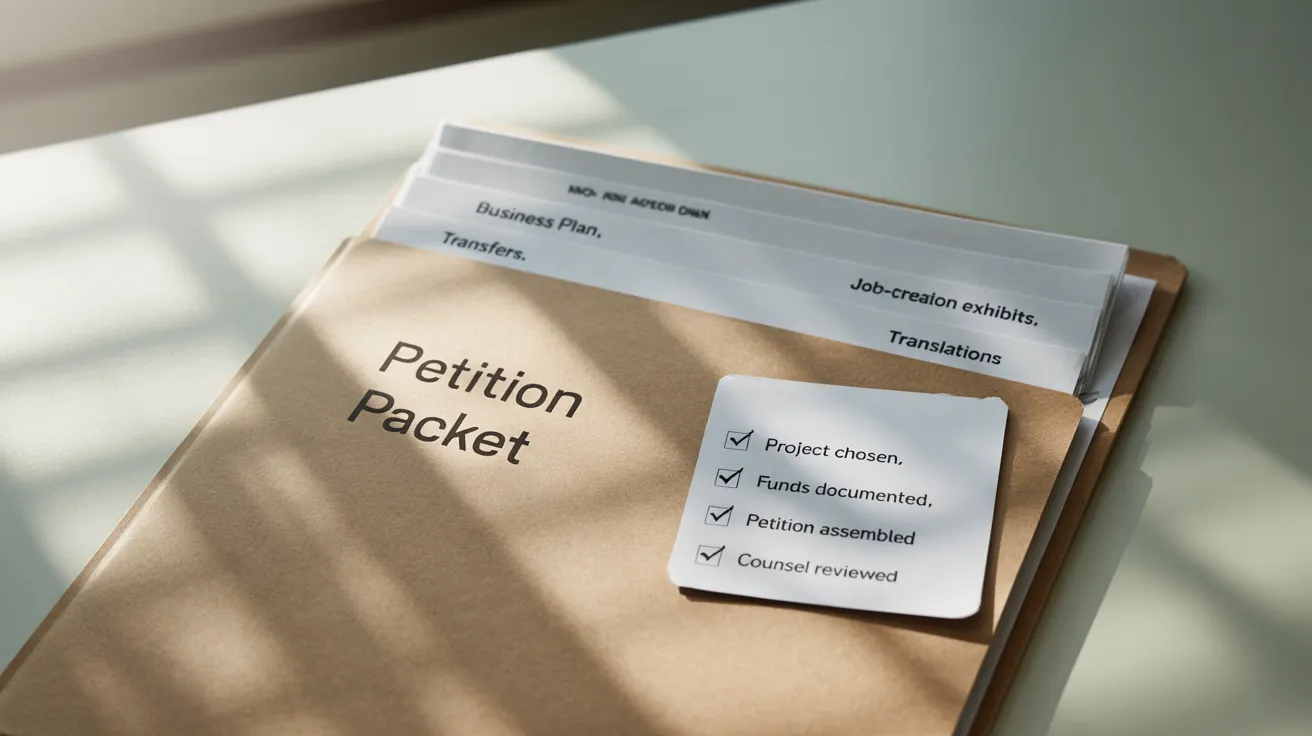

The path to obtaining an EB-5 copyright involves multiple stages for overseas investors to obtain permanent residency in the United States. The first step involves choosing a qualifying investment project, through either direct investment or Regional Center participation. Investors must submit Form I-526 or I-526E petition with USCIS, furnishing extensive documentation of their investment and the legal source of their capital. Upon approval and visa availability, the applicant and qualifying family members obtain a two-year Conditional copyright. During this time, the investment must be sustained and create at least 10 U.S. jobs. Ultimately, the investor files Form I-829 to lift the conditions of copyright and become a lawful copyright.

What investment amount do I need for EB-5?

The required investment amount for the EB-5 program stands at $800,000 for projects situated within a Targeted Employment Area (TEA). A TEA consists of either a high-unemployment region or rural territory. For investments not within a TEA, the minimum investment requirement is $1,050,000. USCIS establishes these investment levels and are an essential consideration in how investors make their decisions. The investment needs to remain at risk for the duration of the conditional residency period and needs to originate from lawful means with full documentation.

How do we define a Targeted Employment Area (TEA)?

A Targeted Employment Area (TEA) represents a geographic area recognized by USCIS that is classified as either a rural location or a location with unemployment rates reaching at least 150% of the national average. The main objective of the TEA designation is to stimulate investment in areas of the country that are most in need. Investing in a TEA-based project permits a potential investor to become eligible for the lower investment threshold of $800,000. TEA classifications are established on precise economic and geographic factors and are revised regularly to account for shifting economic conditions.

What are the key differences between Regional Center and direct investments?

Investors pursuing EB-5 visas have two options for two investment models: a Regional Center or a direct investment. A Regional Center is a USCIS-approved entity that manages investment projects and aggregates investments from multiple applicants. This is a more passive investment option, as the Regional Center handles the day-to-day management and job creation requirements. Regional Centers are able to include indirect and induced jobs toward the employment requirement. A direct investment involves greater personal involvement where the investor is actively involved in the business operations. This option provides greater authority while demanding more operational responsibility from the investor and must solely rely on direct jobs toward the employment requirement.

What's a Conditional copyright?

The Conditional copyright serves as a temporary, two-year residency permit provided to EB-5 investors after they receive I-526 approval and visa availability. It enables the investor and their dependents to work and maintain residence in the U.S. However, the status is temporary upon the investor satisfying all EB-5 program requirements, including sustaining their investment and creating the necessary number of jobs. To remove these conditions, the investor must submit Form I-829 before the conditional period ends. Not filing within the deadline or meet program requirements could trigger loss of status and deportation from the United States.